The digital revolution has made managing your money easier than it has ever been. recharge apps, payment gateways, and UPI have made laborious tasks simple to complete with a single press. These tools are changing the way we manage money, whether it’s for a fast phone recharge or an online UPI payment. Let’s examine how these technologies function to simplify and secure our banking transactions.

Easy phone recharge

The days of frantically trying to locate a real store to buy phone batteries are long gone. Applications like a recharge app have become more popular, allowing you to rapidly top off your phone plan from the comfort of your own home. In addition, the integration of UPI payment gateways speeds up the transaction and eliminates the need for you to repeatedly input your bank information. It’s practical and typically comes with enticing cashback and discount offers.

These apps do far more than just recharge; they can be used for paying bills, purchasing data packs, and even making movie ticket reservations. These tasks are very easy and seamless with UPI integration. Recharge apps make sure you pay for postpaid services or recharge a prepaid plan without any headaches.

Potential of QR codes and UPI

UPI has genuinely changed the way we make payments. The UPI QR code, that allows users to conduct transactions by just scanning a code, is one of the main features. UPI QR codes speed up and secure payments for anything from ordering takeout to paying for shopping.

Because of their extraordinary simplicity, UPI QR codes are quite well-liked by both individuals and small companies. With just a quick scan, anyone may accept payments, from small street vendors to bigger companies. It provides a simple method of making payments for customers without them having to worry about security or remembering their card details.

Payment gateway via UPI for safe transactions

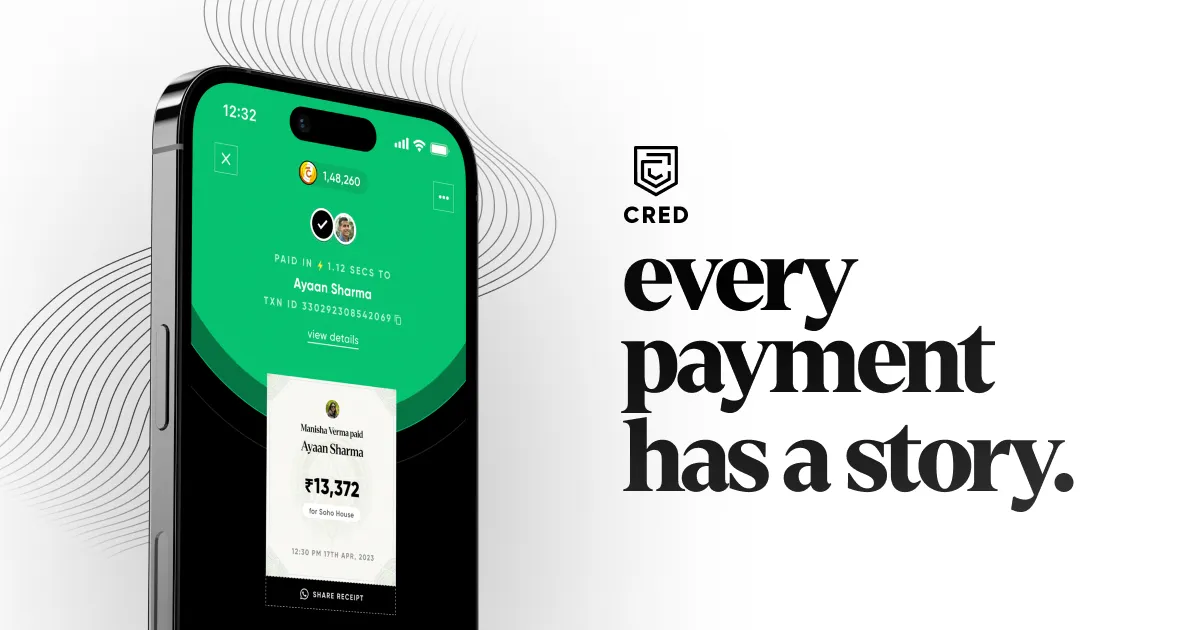

The core of smooth online transactions is the UPI payment gateway. Through this gateway, both individuals and businesses can transfer and receive money without worrying about issues or security. Your payments are secured by authentication and encryption thanks to UPI’s robust infrastructure. Additionally, it makes instantaneous money transfers possible, which is essential for both private and professional operations.

UPI Online Payments

The UPI online payment has made managing anything from utility bill payments to online shopping easier. You can make payments with a few touches instead of manually entering your bank account information. With UPI, all you require is your phone number or UPI ID to link your financial account immediately to the app. Online payments are now very quick, safe, and easy to use thanks to this.

UPI, recharge apps, and payment gateways make money management and payments easier than ever. The process is quick, secure, and easy, regardless of whether you’re purchasing online or you just need to recharge your phone. By enabling you to make payments or even recharge phone with a single scan, UPI QR codes provide an additional level of convenience and help you save time and effort. This seamless experience guarantees that managing your finances and staying connected are always within your reach, whether you’re at home or on the go.

Conclusion:

Our lives are becoming easier as a result of the financial industry’s digital revolution. The way we handle money has been completely transformed by UPI and its associated technologies, such as payment gateways and recharge apps, whether you’re transferring money to friends, shopping for groceries, or recharging your phone. These tools are the digital transaction of the future; they are quick, safe, and simple to use. The next time you need to initiate a payment, just utilize the UPI app, scan the QR code, and take advantage of the convenience and speed it offers.