The digital economy is expanding and leaving no aspect untouched, not even loans. However, loans are granted based on credit scores. Your credit score is important whether you apply for credit card, get a personal loan, or even rent an apartment.

But in this fast-paced life and economy, we sometimes forget to maintain healthy spending habits and a good credit score. Sometimes, for beginners, it becomes too confusing to know what even credit score is.

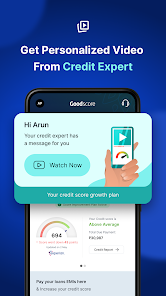

Experian Credit Report is a good place to understand and improve your credit score. Your entire credit history, from your very first credit card swipe to your most recent EMI payment, is documented in your Experian credit report.

Along with Equifax and CIBIL, Experian is one of the three main credit bureaus in India and the world. It gathers, stores, and arranges financial information about your borrowing habits, such as credit card usage, loan history, payment patterns, and outstanding debts. Once a year, you can get your Experian credit report for free from their official website. You will also receive your Experian credit score along with the report. This will give you the groundwork for making improvements.

There is some of the basic advice generally given to maintain a good credit score, some of which are listed below:

The biggest component of your credit score is your payment history. Comprehensive records of late or missed payments are displayed in the Experian report. A single late payment can have a big negative impact on your score. Use a reliable bill payment app to track your bills and pay them on time.

In a similar vein, Experian monitors your timely repayment of any outstanding personal loans or EMIs. Your credit profile suffers when you miss loan payments. Use a loan tracker app to keep your repayment schedule organized and manage your EMIs.

Every credit inquiry made by lenders is shown in the report. A large number of inquiries in a short period can lower your credit score and give the impression that you are credit-hungry.

Older accounts positively impact your credit score because they raise the average age of your credit history. Experian reports display the dates of account opening and closing. Even if you don’t use your older accounts very often, keep them open for a better credit score.

Improving your credit score is not an overnight journey; it takes time, healthy spending habits, and patience to develop a good score. It takes awareness, control, and consistency to raise your credit score; there are no shortcuts. The first line is your Experian credit report, which serves as a mirror reflecting your financial practices. Your credit profile gets stronger the more you comprehend it and take action.

Your credit score is your ticket to better opportunities, whether you’re looking to buy a home, upgrade your vehicle, apply for a business loan, or want peace of mind. Your Experian reports could be the first step to having a better credit score. Don’t miss it.

Not only is it safe and reliable, but it generates your results within minutes, so you can get started on your action without wasting a single second.

Own your credit story. Get your Experian report today.