Using a trading app for investments can prove very beneficial to investors to manage their portfolios well. Let’s look at the key benefits of using a trading app and having a demat account and understand why they’re important for modern day investing –

- Convenience and Accessibility – The biggest advantage of using a trading app is the convenience it provides. They offer real-time access to stocks like Nifty 50 and allow you to track the performance of your investments, and trade in seconds. Whether you’re at home or stuck in traffic, you can trade anywhere thanks to the convenience of trading apps.

- Real time information – A trading application offers real-time access to stock quotes, market news, and detailed information about many companies. Apps like HDFC Securities will help one to access live quotes of the market place, track stock performance, and review current market news all in one place.

- Simple Account Management – A Demat, or dematerialized account holds your shares and other securities in electronic form, removing the need for the traditional physical share certificate. You can check the status of your holdings, and track your profit or loss through the app. This convenience is even more important if you’re investing in multiple assets, like Nifty 50 stocks or other financial instruments.

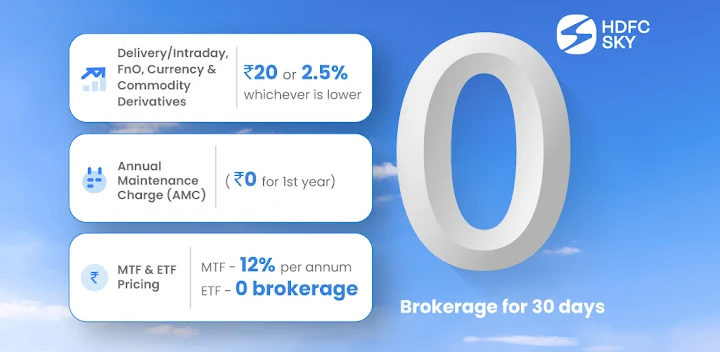

- Lower Costs and Instant Transactions – Investing through a demat account would reduce the transaction costs dramatically as compared to the traditional brokerage services. Trading apps will help you execute buy or sell orders immediately to capitalize on movements in real-time within markets. This process therefore reduces the time and cost to handle investments.

- Portfolio Personalization – One of the best advantages that a trading app provides is that you can personalize and customize your portfolio. Are you interested in a particular blue-chip company, or do you want to start with many different industries? Using a trading app, you can mold your investment according to your financial goals.

- Educational Resources for New Investors – There are many features available on these apps like tutorials, blogs and webinars which can help you learn the basics of investing and how to invest in indices.

For those who are new to investing, a good trading app can provide you a lot of useful information and resources to understand the stock market, trading strategies, and how to use the app effectively which can greatly help you in your investment journey.

Conclusion:

The comfort of real-time data with reduced cost, improved security, and personal portfolio management through such tools makes it easier for investors to control financial goals. Be it investment in the Nifty 50, or participation in stocks of individual companies, or building up a diversified portfolio, trading apps and Demat accounts have become a part and parcel of modern-day trading.