In recent years, financial markets have witnessed a significant shift in how trading activities are conducted, driven largely by the widespread adoption of trading apps. These applications have made investing more accessible, convenient, and efficient for a growing number of traders, ranging from beginners to seasoned investors. Coupled with a Demat Account, trading apps allow users to store and manage securities digitally, eliminating the need for physical share certificates. Understanding the trends in trading app usage provides valuable insights into how technology is transforming market participation and investment behavior.

The Rise of Trading Apps

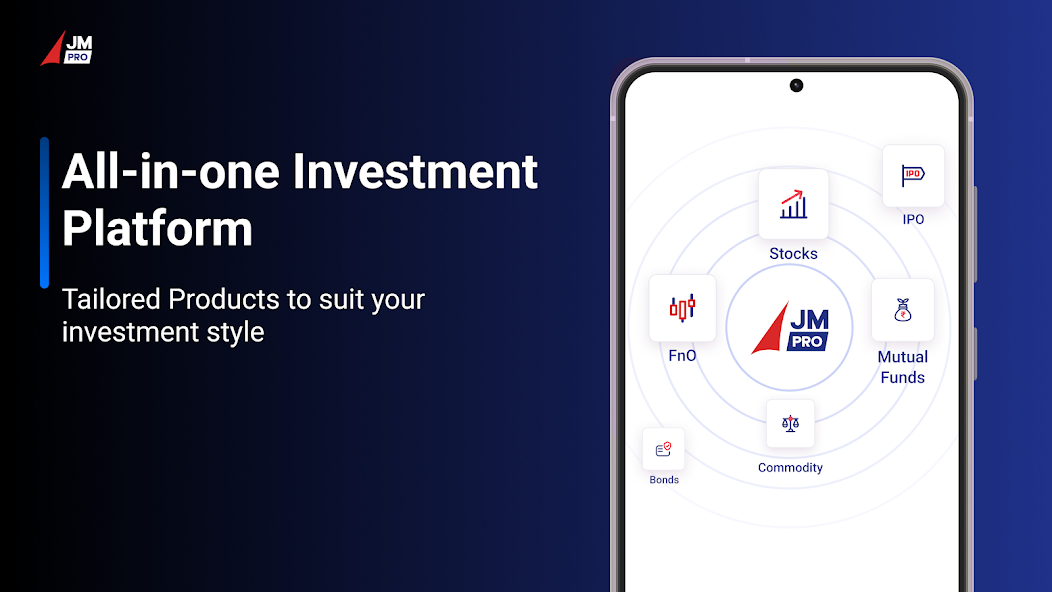

The evolution of trading apps has been one of the most notable developments in financial markets. Earlier, investors relied heavily on brokers and physical paperwork to execute trades. Today, trading apps allow users to buy and sell stocks, track market performance, and access real-time financial data directly from their smartphones or tablets. The convenience offered by these applications is further enhanced when linked with a Demat Account, which ensures secure storage of securities and simplifies portfolio management.

The popularity of trading apps is fueled by their ability to provide a comprehensive trading experience. Users can monitor stock prices, receive alerts, and analyze market trends without needing to access complex trading platforms. This democratization of trading has opened opportunities for individual investors who may have previously been hesitant due to procedural complexities or lack of resources.

Key Features Driving Trading App Adoption

Several factors have contributed to the growing adoption of trading apps among retail and institutional investors:

Real-Time Market Access

One of the most appealing features of trading apps is access to live market updates. Investors can track stock movements, commodity prices, and indices in real-time. Integrating this with a Demat Account ensures that users can immediately act on trading decisions without delays caused by manual processes.

Ease of Portfolio Management

Trading apps allow seamless monitoring and management of investment portfolios. Users can view holdings, track returns, and assess portfolio diversification directly on their devices. This ease of access encourages more consistent investment decisions and better risk management.

Analytical Tools and Insights

Modern trading apps come equipped with analytical tools such as charts, trend indicators, and technical analysis modules. These features help traders make informed decisions and plan strategies based on data-driven insights. When combined with a Demat Account, these tools enhance the ability to monitor long-term holdings effectively.

Secure Transactions

Security is a major concern for investors, and trading apps have adapted to provide encrypted transaction processes, two-factor authentication, and seamless integration with banks. A Demat Account further ensures that investments are held in a secure digital format, reducing the risk of physical loss or fraud.

Trading Apps and Market Behavior Trends

The increased use of trading apps has not only changed how transactions are executed but also influenced market behavior in multiple ways:

Increased Retail Participation

With easy access to trading platforms, more retail investors are entering the market. Trading apps simplify the process of buying and selling shares, allowing even small investors to participate actively. The link to a Demat Account ensures that transactions remain smooth, transparent, and legally compliant.

Shift Toward Mobile-First Trading

Smartphones have become the primary device for market engagement. Investors now rely on mobile trading apps to track prices, execute trades, and analyze trends on the go. This mobile-first approach has prompted developers to enhance user interface design, speed, and app reliability.

Influence on Investment Decisions

Access to instant information through trading apps has affected how decisions are made. Investors now react faster to market news, quarterly earnings, and geopolitical developments. The integration of a Demat Account ensures that portfolio adjustments can be made instantly, minimizing delays and optimizing outcomes.

Future Prospects for Trading Apps

As technology continues to advance, trading apps are expected to evolve further, offering innovative features that enhance user experience and efficiency:

AI-Driven Insights

Artificial intelligence is set to play a significant role in trading app functionality. Predictive analytics, automated recommendations, and sentiment analysis will provide users with smarter decision-making tools.

Expanded Integration

Future trading apps will likely integrate with other financial services, including loans, insurance, and tax solutions. This holistic approach will allow investors to manage all aspects of their financial life from a single platform.

Enhanced Educational Resources

With more first-time investors using trading apps, educational features such as tutorials, webinars, and interactive guides will become increasingly important. Coupled with guidance on managing a Demat Account, these resources can help users develop informed investment strategies.

Tips for Choosing the Right Trading App

Selecting an appropriate trading app is crucial for optimizing investment experience. Consider the following factors:

- User-Friendly Interface: The app should be intuitive and easy to navigate.

- Real-Time Data: Ensure that the app provides accurate and timely market updates.

- Security Measures: Look for apps with encryption, secure login, and two-factor authentication.

- Compatibility with Demat Account: Integration with a Demat Account is essential for seamless trading and holding of securities.

- Analytical Tools: The app should provide charts, trend analysis, and insights to aid decision-making.

Conclusion

Trading apps have transformed the way investors interact with financial markets, making trading accessible, efficient, and data-driven. By combining these applications with a Demat Account, users can experience a secure, streamlined approach to managing investments. The trends indicate continued growth in mobile-based trading, increased retail participation, and enhanced analytical capabilities. As technology advances, trading apps will likely offer more innovative features, ensuring that investors remain equipped to make informed decisions in dynamic markets. Whether you are a beginner or an experienced trader, understanding the evolving landscape of trading apps is essential for navigating today’s financial markets successfully.

The rise of trading apps and their integration with a Demat Account reflect a broader trend toward digital, mobile-first financial management. Staying updated on these trends helps investors optimize strategies, manage risks, and take advantage of the opportunities presented by modern market dynamics.