“Buy stocks!” It’s a phrase that’s popping up everywhere: Instagram reels, podcasts, finance books, and your next-door neighbour. But what if we told you that you can do it too? In this article, we’ve demystified the process, making it accessible for you to start your investing journey on the right foot.

1.How to start?

Investing starts with opening a demat account. In place of actual paper certificates, shares, and securities are held in electronic form in a demat (Dematerialized) account. It functions similarly to a digital safe for your investments. Your demat account is where shares and mutual funds are kept whenever you purchase them. It facilitates safer, quicker, and more seamless trading and investing.

Buying stock entitles you to a portion of the business. The value of your share typically rises if the business expands and performs well.

2.What is ‘Nifty 50’?

The Nifty 50 is a benchmark stock market index on the National Stock Exchange of India (NSE). It represents the top 50 NSE-listed companies chosen for their liquidity and market capitalization. Imagine it as a report card that shows the overall performance of the Indian stock market.

These businesses come from various industries, including banking, energy, pharmaceuticals, and information technology, making it a reliable gauge of India’s economic health. If the Nifty 50 rises, the market usually does well. If it declines, the economy may become unstable or cause worries.

3.What is option trading?

One kind of derivatives trading is options trading, in which you purchase or sell the right, but not the responsibility, to purchase or sell an asset, stock, or index at a specific price within a given window of time.

You’re trading the option to buy or sell the stock at a later time rather than actually purchasing it.

An options trading app can help you trade options, track market prices, analyze charts, place trades in real time, and manage your derivatives portfolio.

- Ten tips for good grips:

- Always research the stocks you are investing in well, check charts, analyze history, and consult experts.

- You don’t need to buy and sell every day.

- Look at brokerage charges and taxes that eat into profits.

- Don’t chase popular stocks. Popularity doesn’t equate to credibility.

- Start small, but start early.

- Track and journal your progress.

- Don’t put all your money in one stock or one sector.

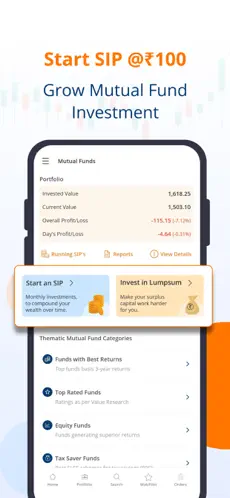

- Use an investing app that is trusted, secure, and transparent.

- Ask for help when necessary; experts are experts for a reason.

- Don’t invest in glamour; invest in financial security. You might not get rich overnight.

If you have been thinking about investing for a long time, now is the right time. Safe and secure investments not only secure your future but also let your money grow in real-time.

To begin investing, you don’t have to be an expert in finance. All you have to do is begin. It becomes less of a mystery and more of an opportunity once you grasp the fundamentals.

The most astute investors are those who never stop learning, not those who know everything. Start slowly, maintain your curiosity, and keep these tips in mind.